Why Should I Set Up a SMSF?

1. Understanding the Basics of SMSF

Before diving into the reasons for setting up a Self-Managed Superannuation Fund (SMSF), it’s essential to understand the basics. An SMSF is a private super fund that gives you more control over your retirement savings compared to traditional funds. Why should I set up a SMSF?

1.1 Flexibility in Investment Choices

One of the primary advantages of an SMSF is the flexibility it offers in choosing your investments. Unlike conventional super funds, where your choices are limited, an SMSF allows you to invest in a diverse range of assets, including property, stocks, and more.

1.2 Control Over Investment Strategy

Setting up an SMSF provides you with the autonomy to create and control your investment strategy. This control empowers you to align your investments with your risk tolerance, financial goals, and market conditions.

2. Cost Efficiency and Potential Tax Benefits

While managing your own super fund involves responsibilities, it can also be cost-effective, especially for those with substantial balances. The ability to pool family assets into a single fund may result in significant cost savings compared to multiple individual accounts.

2.1 Tax Planning Opportunities

Another compelling reason to set up an SMSF is the potential for tax planning. With careful management, you can strategically minimize your tax liability, taking advantage of various tax concessions and deductions available to SMSFs.

2.2 Estate Planning and Inheritance

Creating an SMSF allows you to incorporate estate planning into your retirement strategy. You can structure your fund to facilitate the seamless transfer of wealth to beneficiaries, providing financial security for your loved ones.

3. Enhanced Control Over Retirement Planning

Retirement planning involves more than just accumulating wealth; it’s about managing your finances to ensure a comfortable and secure retirement. An SMSF offers enhanced control over various aspects of your retirement planning.

3.1 Tailored Pension Strategies

With an SMSF, you have the flexibility to create personalized pension strategies that suit your retirement needs. This includes choosing when and how you receive pension payments, providing greater control over your income stream in retirement.

3.2 Direct Involvement in Decision-Making

Unlike industry or retail super funds, where decisions are made by fund managers, an SMSF allows you to be directly involved in decision-making. This hands-on approach ensures that your retirement strategy aligns with your unique financial goals and circumstances.

4. Regulatory Compliance and Professional Guidance

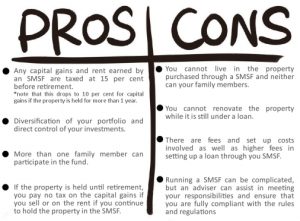

While an SMSF offers increased control, it comes with the responsibility of complying with regulatory requirements. Engaging with professionals, such as accountants and financial advisors, can help navigate the complexities of SMSF compliance.

4.1 Professional Advice for Optimal Performance

Seeking professional advice is crucial when managing an SMSF. Financial experts can provide guidance on investment decisions, tax planning, and compliance matters, ensuring that your fund operates efficiently and within legal boundaries.

4.2 Staying Informed About Regulatory Changes

Being proactive in staying informed about regulatory changes is essential for SMSF trustees. Regular updates from professionals help you adapt to any amendments in superannuation laws, ensuring ongoing compliance and the success of your SMSF.

5. Conclusion: Empower Your Financial Future with an SMSF

In conclusion, setting up a Self-Managed Superannuation Fund (SMSF) offers a range of benefits, from increased control over investments to potential cost savings and tax advantages. While it involves additional responsibilities, the ability to tailor your retirement strategy to your unique circumstances is a compelling reason for many individuals to choose an SMSF.

Remember that the decision to establish an SMSF should be based on careful consideration of your financial goals, risk tolerance, and commitment to managing the fund effectively. Seeking professional advice is key to maximizing the benefits of an SMSF and ensuring regulatory compliance.