Unlocking the Potential: Can I Start a SMSF with $100,000?

In the realm of personal finance, the Self-Managed Superannuation Fund (SMSF) stands out as an enticing option for those looking to take control of their retirement savings. But a burning question often lingers – is $100,000 a sufficient starting point for venturing into the world of SMSFs? In this comprehensive guide, we’ll delve into the possibilities and considerations surrounding the establishment of an SMSF with a $100,000 foundation. Can I start a SMSF with $100000?

The Basics of SMSF

Before exploring the financial viability of initiating an SMSF with $100,000, it’s crucial to understand the basics of what an SMSF entails. An SMSF is a private superannuation fund that allows individuals to control and manage their retirement savings. This control extends to investment decisions, providing a level of autonomy not found in traditional superannuation funds.

The Regulatory Landscape

The Australian Taxation Office (ATO) regulates SMSFs, ensuring compliance with stringent rules and regulations. One of these rules relates to the minimum balance required to establish an SMSF. While there isn’t a specific mandated minimum, a general guideline suggests a minimum of $100,000 to make the venture economically viable.

Financial Considerations

Now, let’s address the financial aspects of starting an SMSF with $100,000. While this amount may seem substantial, it’s essential to evaluate whether it aligns with your long-term financial goals and the inherent costs associated with managing an SMSF.

Initial Setup Costs

Establishing an SMSF incurs initial setup costs, including legal and administrative expenses. While $100,000 provides a reasonable starting point, prospective trustees should factor in these costs, ensuring they don’t significantly deplete the fund’s initial balance.

Investment Diversification

With $100,000 at your disposal, thoughtful investment strategies become paramount. Diversifying your portfolio across asset classes like equities, property, and fixed income can help mitigate risk and optimize returns. It’s advisable to seek professional financial advice to craft a tailored investment strategy that aligns with your risk tolerance and retirement goals.

Ongoing Operational Costs

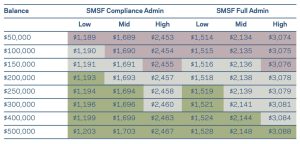

Managing an SMSF involves ongoing operational costs that trustees must consider. These costs include accounting, auditing, and regulatory fees. Allocating a portion of the initial $100,000 to cover these expenses ensures the SMSF’s smooth operation without compromising its financial health.

Professional Guidance

Engaging with financial professionals, such as accountants and financial advisors, becomes crucial when navigating the complexities of an SMSF. While this incurs additional costs, the expertise they bring to the table can significantly impact the fund’s performance and compliance with regulatory requirements.

Risk Management and Contingencies

With any investment venture, understanding and managing risks are key to long-term success. Allocate a portion of the $100,000 to build an emergency fund within the SMSF. This acts as a financial buffer, safeguarding against unforeseen circumstances and market volatility.

Review and Adjust

Regularly reviewing the SMSF’s performance and adjusting the investment strategy accordingly is fundamental. With $100,000, trustees should remain vigilant, leveraging market opportunities and adapting to changing economic conditions. https://smsfauditshop.com.au/affordable-online-smsf-auditing/

Conclusion: Making Informed Decisions

In conclusion, starting an SMSF with $100,000 is indeed feasible, provided careful consideration of both the regulatory landscape and financial dynamics. While this amount provides a solid foundation, prudent decision-making, ongoing management, and professional guidance are imperative for long-term success. As with any financial endeavor, thorough research and a clear understanding of your financial goals are the cornerstones of a successful SMSF journey. Remember, the journey towards financial freedom starts with an informed decision today.